By Sandeep Chaudhary

Rise in Deposits and Private Sector Credit Signals Recovery in Nepal’s Financial Sector

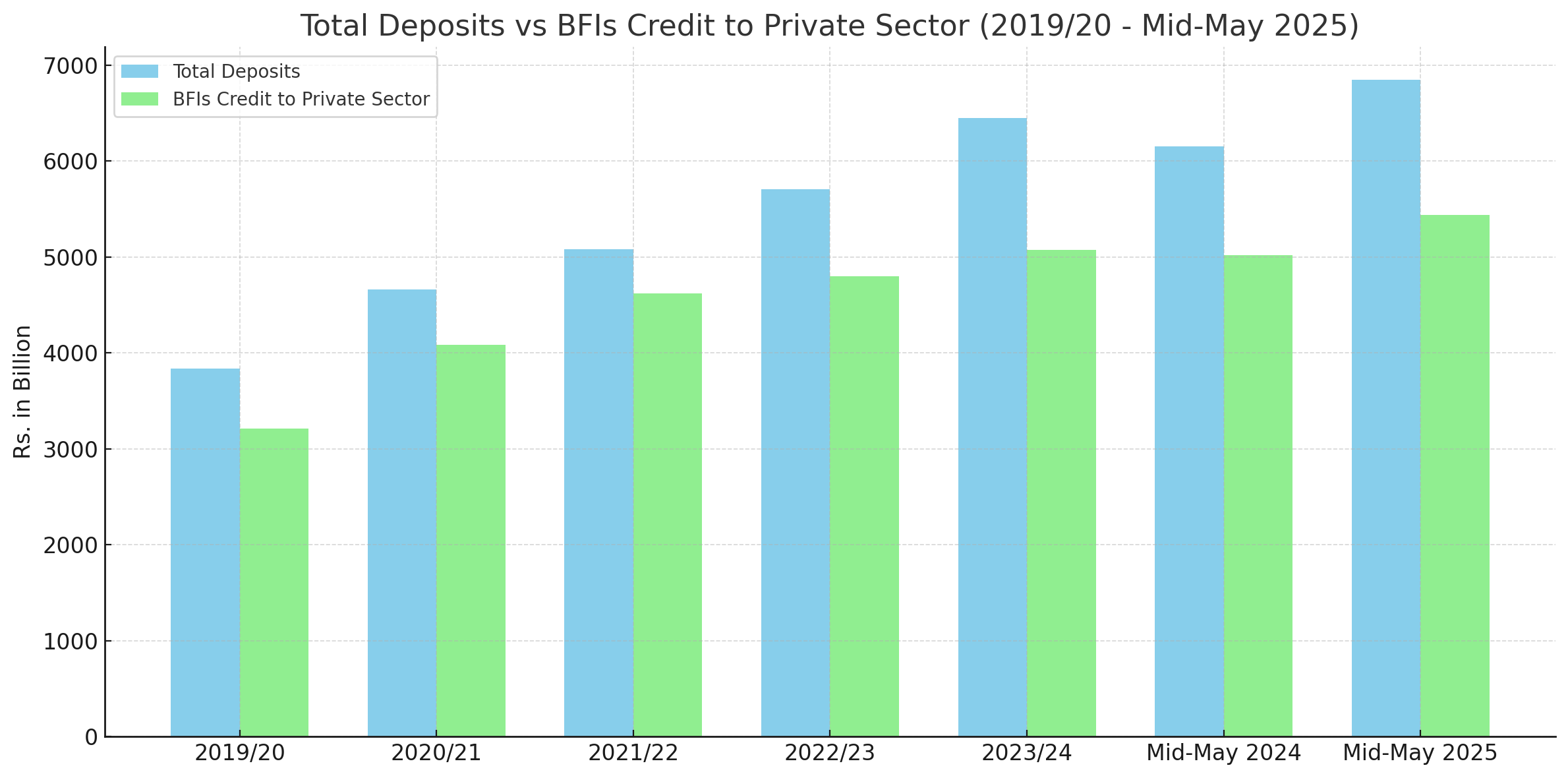

Nepal’s financial sector has demonstrated strong growth momentum in both deposits and private sector lending, according to the latest mid-May 2025 data. The total deposits held by Banks and Financial Institutions (BFIs) reached a record Rs. 6852.2 billion, showing a notable increase from Rs. 6153.1 billion in mid-May 2024. This reflects the growing trust of the public in the banking system and improved liquidity in the economy.

Over the past five fiscal years, deposits have steadily increased—from Rs. 3839.7 billion in 2019/20 to Rs. 6452.4 billion in 2023/24. The mid-May 2025 figure indicates an annual increase of approximately 11.3%, hinting at sustained savings and remittance inflows despite economic pressures.

Similarly, the credit flow to the private sector by BFIs has also maintained an upward trajectory, reaching Rs. 5442.6 billion in mid-May 2025, up from Rs. 5022.3 billion the previous year. This suggests a rebound in private sector borrowing, which had seen subdued growth during and after the pandemic years. From Rs. 3209.8 billion in 2019/20, credit has expanded consistently, peaking at Rs. 5074.0 billion in 2023/24.

The narrowing gap between deposits and private sector credit in recent months reflects increasing financial intermediation efficiency. However, maintaining a balanced growth to avoid overheating of the credit market remains crucial. The figures suggest improving investor confidence and economic activity, positioning Nepal for further financial deepening and capital mobilization in the coming quarters.