By Sandeep Chaudhary

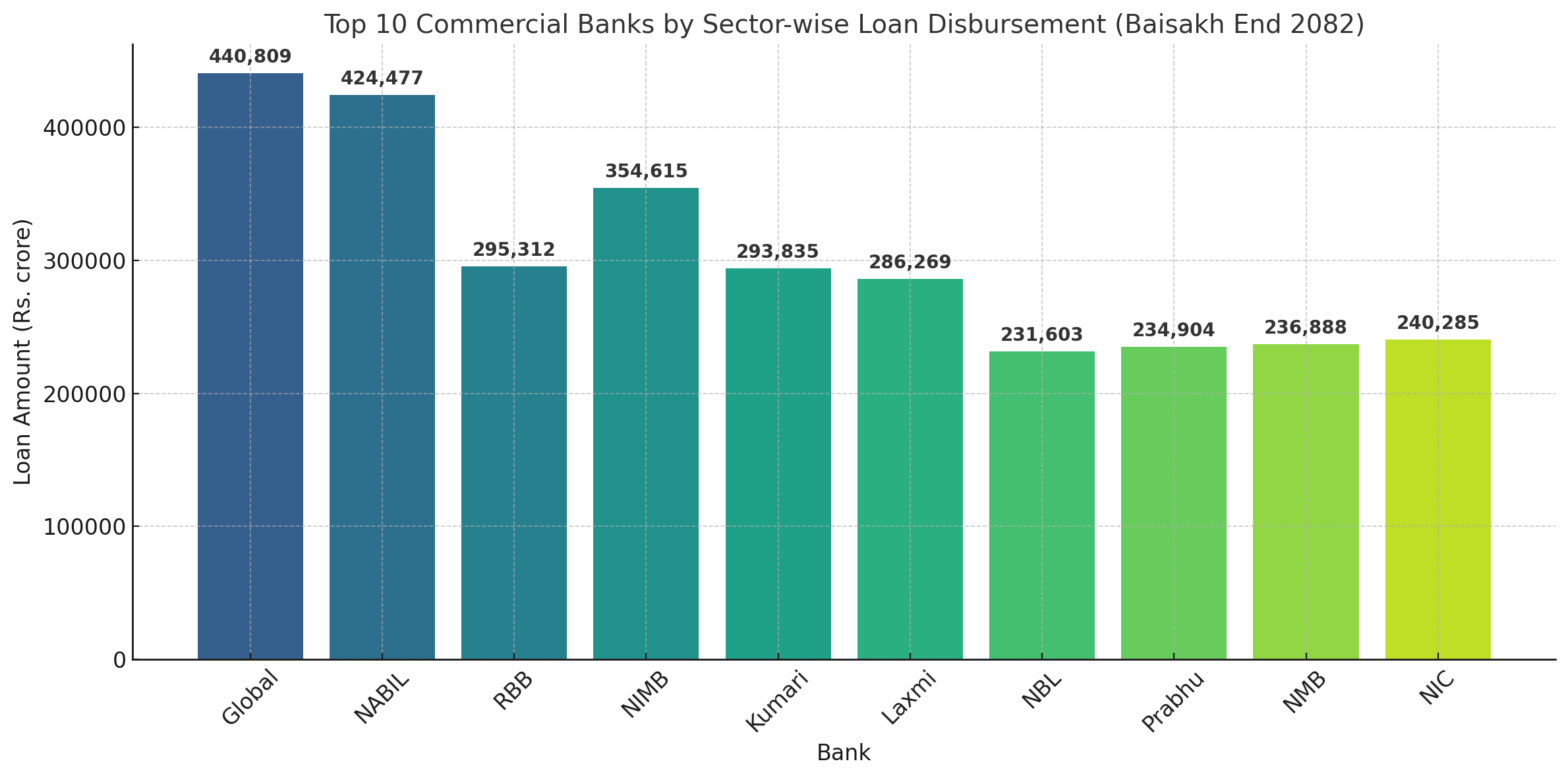

Sector-wise Loan Disbursement by Commercial Banks Crosses Rs. 44 Kharba by Baisakh End 2082

Kathmandu, June 2025 – Commercial banks in Nepal have disbursed more than Rs. 4.40 trillion (Kharba) in loans across various sectors by the end of Baisakh 2082 (Mid-May 2025), according to the latest data compiled from 20 Class "A" banks. This comprehensive sector-wise distribution of credit reveals major lending priorities and trends shaping the banking landscape.

Wholesale & Retail Sector Remains Top Priority

The Wholesale and Retail Trade sector emerged as the largest beneficiary, receiving the highest cumulative credit of over Rs. 7.76 Kharba across all banks. NABIL Bank alone extended Rs. 92.45 Arba, followed by NIC Asia (Rs. 59.47 Arba), and Global IME (Rs. 92.95 Arba). This reflects banks' strong preference for trade finance and short-term working capital loans.

Personal Consumption Loans See Massive Uptake

Consumption loans stood out as another dominant category, with total disbursements across banks exceeding Rs. 6.44 Kharba. NBL (Rs. 72.86 Arba), Global IME (Rs. 97.75 Arba), and Laxmi Bank (Rs. 57.42 Arba) were the top contributors. This trend suggests rising household borrowing, possibly for education, travel, gadgets, and personal spending.

Productive Sectors Show Promising Growth

Lending to Agriculture, Forestry, Beverage & Non-Food Production saw notable investments. NIMB led the category with over Rs. 102.80 Arba, followed by NABIL and Global IME. These figures indicate a growing shift toward agro-based industries and value-added production.

Similarly, the Electricity, Gas, and Water sector attracted over Rs. 38.45 Arba from NABIL alone. Combined figures show that power and infrastructure financing remains a key priority for long-term national development.

Real Estate and Construction Remain Key Segments

The Finance, Insurance, and Real Estate sector saw significant funding, particularly from NIMB (Rs. 32.79 Arba), Laxmi Bank, and Global IME. This segment aligns with increasing investments in housing, office space, and commercial properties. The Construction sector also witnessed substantial flows, with NABIL (Rs. 25.56 Arba) and Kumari Bank (Rs. 15.95 Arba) making strong contributions.

Tourism, Services, and Industry in Focus

In line with Nepal’s push for tourism revival post-pandemic, NIMB disbursed Rs. 22.97 Arba in tourism-related loans, the highest among peers. Prabhu Bank and NMB followed suit, suggesting a revived interest in hospitality and travel-based ventures.

Sectors like Other Services, Transport & Communication, and Machinery/Equipment received moderate funding, signaling opportunities for growth with targeted lending products.

Agriculture and Fishery Still Underserved

Despite being a critical sector for national employment, agriculture-related lending remains concentrated in a few banks. ADBNL leads with Rs. 59.46 Arba, followed by NIC Asia. However, most banks’ exposure remains under Rs. 15 Arba.

Fishery and Mining sectors continue to be marginal in credit allocation. Only a few banks—like NIC Asia and NIMB—have made notable investments in these areas, highlighting the need for policy push and risk mitigation tools.

Bank-wise Highlights

Global IME Bank tops the list with the highest total sector-wise loan portfolio of Rs. 4.40 Kharba, followed by NABIL Bank (Rs. 4.24 Kharba) and RBB (Rs. 2.95 Kharba).

NMB, Kumari, and Laxmi Bank displayed well-diversified loan books with a healthy mix of personal, commercial, and infrastructure loans.

Banks like SCBNL and NSBI have lower overall disbursements, showing conservative lending or niche market focus.