By Sandeep Chaudhary

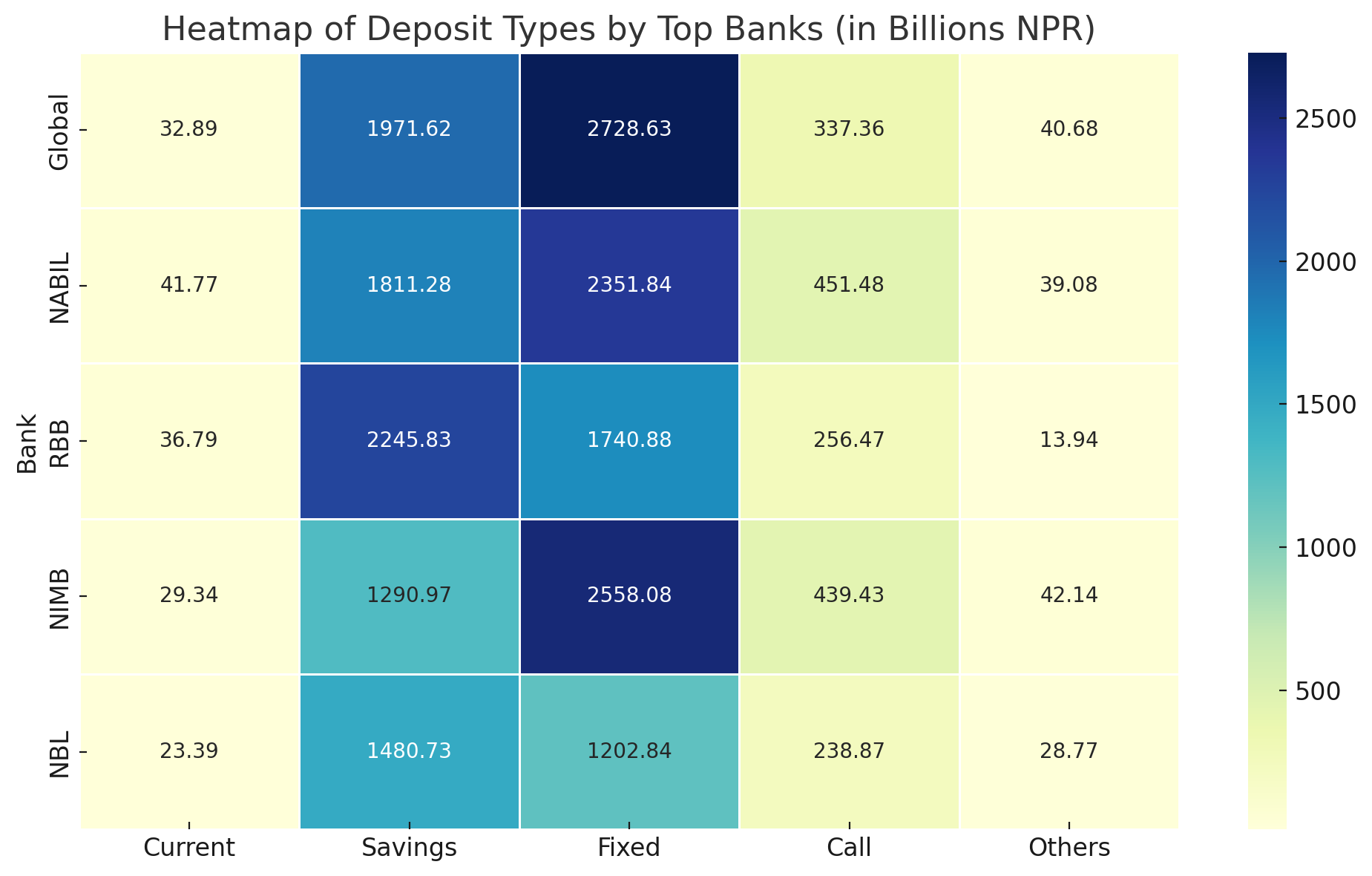

Top 5 banks in Nepal by deposit types as of Baisakh End 2082

As of the end of Baisakh 2082 (mid-May 2025), Nepal’s major commercial banks have shown solid deposit mobilization, with total deposits across 20 key banks surpassing NPR 70 trillion. Among them, Global IME Bank leads with the highest deposit base at NPR 5.40 trillion, followed by NABIL Bank at NPR 5.07 trillion, Rastriya Banijya Bank (RBB) at NPR 4.62 trillion, and Nepal Investment Mega Bank (NIMB) also close behind at NPR 4.62 trillion. These figures highlight their strong customer base and extensive deposit collection capacity.

The deposit composition reveals that savings deposits form the largest portion of total liabilities in most banks. For instance, RBB holds over NPR 2.24 trillion and Kumari Bank holds more than NPR 1.09 trillion in savings accounts alone. Fixed deposits have also gained momentum, especially in banks like NIMB (NPR 2.55 trillion), NABIL (NPR 2.35 trillion), and Global IME (NPR 2.72 trillion), indicating growing investor confidence in locking in funds for higher returns. Current deposits, typically linked to corporate and transactional usage, are comparatively lower in volume, with NABIL (NPR 41.77 billion) and RBB (NPR 36.79 billion) leading in this category.

Call deposits—used for short-term liquidity—also show considerable figures, particularly at NABIL (NPR 45.14 billion), NIMB (NPR 43.94 billion), and Global IME Bank (NPR 33.73 billion). Meanwhile, the share of foreign deposits remains minimal, usually below 1% of total deposits, except in a few banks like NABIL and HBL, where foreign current and fixed deposits are slightly higher, likely reflecting remittance flows or NRN accounts.

Overall, Nepal’s banking system remains heavily domestic-driven, with savings and fixed deposits forming the core foundation of funding. The low presence of foreign currency deposits suggests potential areas for growth, especially in tapping into diaspora investments. The dominance of a few key banks in all deposit categories further reflects strong brand loyalty and widespread reach.