By Sandeep Chaudhary

Understanding Total Capital Fund (Tier I and Tier II Capital) According to NRB Guidelines

Total Capital Fund is a comprehensive measure of a bank's financial stability and resilience, combining Tier I and Tier II capital. As per Nepal Rastra Bank (NRB) guidelines, this total capital fund is essential for absorbing losses and ensuring the bank's operational continuity. Here's a detailed explanation of the components and the formula for calculating the Total Capital Fund.

Components of Total Capital Fund

Tier I Capital (Core Capital):

Paid-up Equity Capital: The funds raised from shareholders in exchange for stock.

Share Premium: The excess amount received over the nominal value of shares.

Non-redeemable Preference Shares: Preference shares that are not redeemable, contributing to the permanent capital.

General Reserves: Reserves allocated from profits for future contingencies.

Retained Earnings: Profits kept in the bank after distributing dividends.

Capital Redemption Reserve: Reserve created when a bank buys back its shares.

Other Free Reserves: Reserves available for use without specific restrictions.

Tier II Capital (Supplementary Capital):

Subordinated Debt: Long-term debt instruments that rank below other debts in case of liquidation.

Hybrid Capital Instruments: Financial instruments that have both debt and equity characteristics.

Revaluation Reserves: Reserves arising from the revaluation of the bank's assets.

General Loan Loss Reserves: Provisions set aside for potential loan losses.

Undisclosed Reserves: Reserves that are not disclosed in the financial statements but are approved by the NRB.

Exchange Equalization Reserves: Reserves maintained to offset potential losses from currency exchange fluctuations.

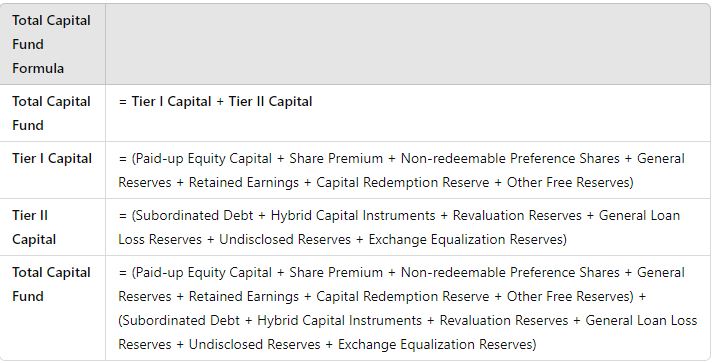

NRB Formula for Total Capital Fund

The NRB provides a formula to calculate the Total Capital Fund, which combines both Tier I and Tier II capital components:

Importance of Total Capital Fund

Total Capital Fund represents the full scope of a bank's capital base, reflecting its ability to absorb losses and support operations during financial stress. It includes both the most permanent capital (Tier I) and supplementary capital (Tier II), providing a broader cushion against risks.

Risk Management: Ensures that the bank can absorb potential losses.

Regulatory Compliance: Meets NRB's capital adequacy requirements.

Operational Stability: Maintains the bank's ability to operate smoothly, even under adverse conditions.

In conclusion, maintaining a strong Total Capital Fund, as per NRB guidelines, is crucial for a bank's financial health. It ensures the bank's resilience to economic shocks, compliance with regulatory standards, and overall stability in the financial sector.