By Dipesh Ghimire

Analysis of Supply Strength Zones in Market Trends: A Detailed Breakdown

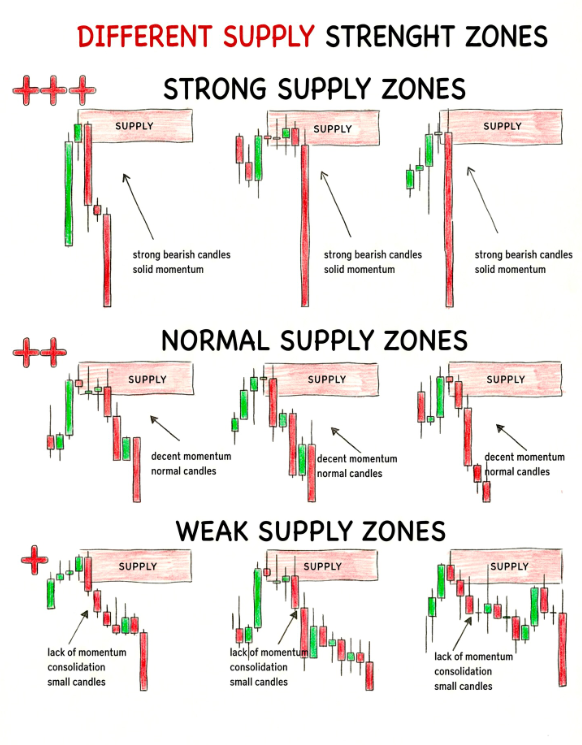

In recent market analysis, the concept of "Supply Strength Zones" has gained significant attention among traders. These zones, categorized into Strong Supply Zones, Normal Supply Zones, and Weak Supply Zones, provide valuable insights into the behavior of price action and are essential for predicting potential market movements. A deeper understanding of these zones can help investors make informed decisions and improve their trading strategies.

Strong Supply Zones: A Powerful Resistance

The Strong Supply Zones, as depicted in the latest market analysis, are marked by strong bearish candles with solid momentum. These zones act as powerful resistance areas where price tends to reverse significantly. The key feature of these zones is that the momentum behind the bearish candles is substantial, meaning sellers have enough control to drive the price lower consistently.

For traders, these zones are often seen as high-conviction areas for shorting the market. As the price approaches these zones, the market is expected to experience a sharp drop due to overwhelming selling pressure. In such cases, traders often anticipate quick reversals and prepare to enter short positions with confidence.

Normal Supply Zones: Balanced Resistance

Moving down the scale, we encounter Normal Supply Zones, characterized by decent momentum and normal candles. These zones represent a moderate resistance area, where the momentum is still bearish, but not as powerful as in strong supply zones. In these zones, price may consolidate and face resistance, but the drop is typically less pronounced.

For traders, these zones are seen as typical areas of resistance. While a reversal is expected, it may not be as sharp or dramatic as in strong supply zones. This presents an opportunity for cautious traders, who may choose to wait for further confirmation of a price reversal before making an entry. The movement is more gradual, with some consolidation periods, making these zones less risky compared to the strong supply zones.

Weak Supply Zones: Minimal Resistance

At the opposite end of the spectrum, we have the Weak Supply Zones, which display a lack of momentum, consolidation, and small candles. These characteristics suggest a weakening resistance, where the selling pressure is not sufficient to keep the price from moving upwards.

In these zones, the market may struggle to push the price lower, and there is a high likelihood that the price could break through with minimal resistance. For traders, weak supply zones are often seen as poor areas for shorting, as they do not offer the same level of reliability for reversals. Instead, traders may focus on other opportunities or look for breaks in the zone, anticipating further upward movement.

Implications for Traders: Risk and Reward

The categorization of supply strength zones offers valuable guidance for traders. Strong supply zones present the highest risk and reward potential, with sharp reversals expected. In contrast, normal supply zones offer more balanced opportunities, with moderate risk and reward dynamics. Weak supply zones, while seemingly less attractive for short positions, can present opportunities for breakout trades or other strategies that capitalize on minimal resistance.

Understanding these zones is crucial for traders seeking to optimize their entries and exits. By recognizing the strength or weakness of a supply zone, traders can adjust their strategies accordingly, either focusing on high-conviction trades in strong supply zones or exploring other opportunities in weak supply zones.

In conclusion, the analysis of supply strength zones is an essential tool for navigating the complexities of market movements. These zones help traders assess the potential for price reversals and provide insights into the broader market sentiment. By identifying the strength of supply in various zones, traders can make more informed decisions and better position themselves to capitalize on price movements, whether through shorting in strong supply zones or looking for breakouts in weak supply areas.

As the market continues to evolve, the understanding of supply strength zones remains a key component in any trader’s toolkit, providing a clearer picture of where the market is headed and how to position trades effectively.